Line of Credit

Flexible credit lines to power your business

Access up to $5M with on-demand withdrawals, simple repayment terms, and funding that moves as fast as you do.

True Lines

of credit, from $10K – $5M.

12-month

repayment terms, resets after each withdrawal.

Simple

customizable weekly payments.

Instant

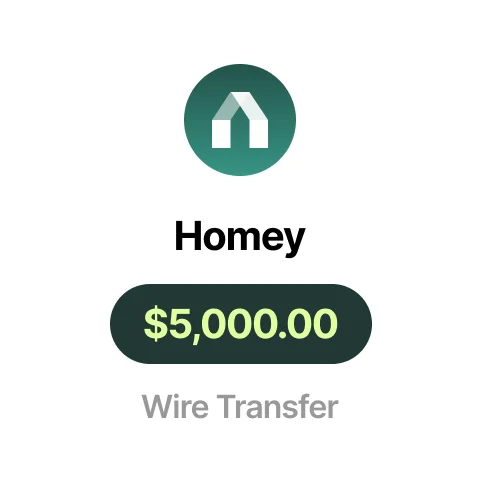

receive your money within seconds – 24/7.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Put your working

capital to work

Unlock flexible funding you can use when and where you need it

For payroll, inventory, operations, and more.

Only pay for what you borrow

Withdraw what you need when you need it. You'll only be charged interest on the funds you draw.

Instant funding, no questions

Receive your money within seconds when you make a withdrawal - 24/7 even on nights and weekends.

Build Business Credit

We report to business credit bureaus, which helps build business credit with on-time payments.

From $10,000 up to $5,000,000

We offer extended lines of credit with the dollar amount going up to $2M for your flexibility.

Are we a Match?

We keep it simple — if you meet these core requirements, you’re likely eligible for fast funding through our streamlined process.

1 year

in business, at least.

625+

personal FICO score.

$ 100 k+

in growth annual revenue.

Business

checking account.

Frequently Asked Questions

Check our consolidated list of frequently asked questions to help you navigate our lines of credit.

How does my line of credit payback work?

With a CapitalArcFunding – Line of Credit, draws are consolidated into one loan with one easy weekly payment. As you pay back your principal, you replenish available funds. Unlike most other online lenders, our line of credit comes with no draw fees (just a monthly maintenance fee). Adjust the payment amount and term to ensure a comfortable weekly payment.

Can I get a credit line increase?

There are some times when you could really use access to additional funds. Based on your cash flow, net income and payback history, you may be eligible for a credit line increase.

How much will it cost?

The total cost of your line of credit will vary based on a number of factors, including your personal and business credit scores, time in business and annual revenue and cash flow.

What other small business loans can I get in addition to my line of credit?

You may have a project that could benefit from other types of small business loans beyond your business line of credit. At CapitalArcFunding we understand, and we offer term loans that provide lump-sum funding up to $250,000. Reach out to your dedicated loan advisor if you think a term loan could help your business.

How can I use my line of credit to build business credit?

We report your payments to business credit bureaus so that every time you pay on time, you’re helping your business build a strong credit profile.

What are the types of business lines of credit?

Secured business line of credit. This type of line of credit requires businesses to put up specific assets as collateral. Since a line of credit is a short-term liability, lenders typically ask for short-term assets, like accounts receivable or inventory.

Unsecured line of credit. While this type of line of credit doesn’t require specific collateral, your lender will likely place a general lien on your business and require a personal guarantee from you. You’ll likely need a stronger credit profile to qualify and interest rates may be higher. Additionally, keep in mind that unsecured lines of credit typically come with a lower credit limit.

Revolving line of credit. With this type of line of credit, you replenish your available funds as you repay what you borrow. This gives you access to future funding without needing to reapply. CaptialArcFunding business line of credit is a revolving line of credit.

Non-revolving line of credit. A non-revolving line of credit is just like a revolving line of credit except your available funding doesn’t replenish as you make payments. You’re given a capped credit limit, and when you reach that amount, you exhaust your funding.

Let's Talk About

What Works For You

Whether you’re ready to apply or just have questions, our team is here to guide you.

No pressure, no commitments. Call or click to get started